Now What? Better Cost-Based Pricing, or Value-Based Pricing?

Over the past 40 years, we’ve read many things about value-based pricing and the benefits it can bring to the bottom line. Pricing scholars, consultants, and experts highly recommend value-based pricing as a pricing approach and praise it over cost-based pricing and competition-based pricing. The same people write about the dangers of formula-based pricing and, specifically, the evil that cost-plus pricing strategies can do to a firm’s profitability. In the context of this COVID crisis, it is important to encourage manufacturing companies to get started with pricing and improve their capabilities. There are ways to get started without breaking the bank. The question is: do they improve their current cost-plus pricing practices, or do they embark now on the journey to pricing based on customer value. My answer is simple. Do both but focus a lot more now on capturing low-hanging fruits.

From Basic to Advanced Cost-based Pricing

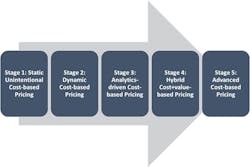

There is cost-based pricing and there is cost-based pricing. We are no longer in the dark ages when folks calculated costs with rules and old machines and wrote them in a book! Over the years, cost-based pricing has improved tremendously. I propose five levels of maturity in cost-based pricing, as shown in the figure below.

Five Stages of Cost-based Pricing Maturity

Stage 1: Static Unintentional Cost-Based Pricing: When companies do not manage pricing and the pricing process is fragmented among various functions, cost-based pricing becomes the norm. Because of the lack of formalization and pricing discipline, it is therefore the worst situation possible. Here, the potential of margin erosion is very high especially when costs decline and the salesforce is in charge of managing price changes.

Stage 2: Dynamic Cost-Based Pricing: Since the 1990s, though, the concept of dynamic cost-based pricing has emerged in the literature to help companies better adapt in industries facing fluctuations in commodity prices. Some of these companies separate the materials side of their costs from the processing side of their costs. They have educated their customers about the need to dynamically re-price their commodity-driven products. For example, you might change your commodity prices daily, weekly, or monthly, and publish an annual price list for your processing, and service offerings. By doing this, you pass cost increases or decreases through to the market.

Stage 3: Analytics-Driven Cost-Based Pricing: With the emergence of better pricing tools, pricing, finance, and costing professionals can mine historical transactional data to better guide their future pricing decisions. By explaining the past, they can better predict the future. However, if past pricing transactions are based solely on costs, then recommendations coming from any pricing tools will be anchored in costs. The difference here is that they might be able to find pockets of price improvements to increase their level of pricing realization.

Stage 4: Hybrid Cost+Value-Based Pricing: The next step toward cost-based pricing excellence is to combine cost-based pricing quantitative science with qualitative and intuitive customer value information. By drawing from collective intuition, managers can develop a cost-based approach combined with an internally perceived premium that they might be able to justify to the market. Therefore, their thinking might go like this: “Our margin target of 30% is met, and we think we can get an extra 5% because of our performance and our brand.” This makes it a hybrid cost+value-based pricing approach. The extra premium is based on gut and experience.

Stage 5: Advanced Cost-Based Pricing: This fifth stage of cost-based pricing maturity combines the dynamic aspect of cost-based pricing supported by legacy and intuitive pricing knowledge with pricing analytics. The difference here is the formalization in pricing realization and the overall intention. This is where you can find companies delivering high EBIT results by embracing integrative and advanced cost-based pricing. I meet plenty of leaders who know about value-based pricing and who have tried it. They are not willing to make the investments at this time and are willing to use qualitative information based on soft data and legacy premium analysis.

So here it is. If you are mostly doing cost-based pricing in your company today, where do you think you stand along the maturity curve? Depending on where you stand today and in the new normal post COVID, is it more worthwhile to improve on this maturity model or to begin a value-based pricing transformation? My first reaction is always to improve what you are doing today and capture the low-hanging fruits. Injecting more discipline in cost-based practices can bring very short-term benefits.

Getting Started with Value-based Pricing

Starting a value-based pricing transformation in the middle of a major recession is not an easy proposition. Although it might be needed, it is hard to justify the payback if you consider the following:

1. Value-based pricing costs more upfront, especially for firms that lack customer intimacy and competitors’ information. They will have to invest in developing and executing customer intimacy programs, which can be costly.

2. The positive impact and payback of value-based pricing might take a while to appear in your gross margins. Pricing consultants often promise a 5 to 8% increase in margin within the first 2 years of a large value-based pricing project. In comparison, cost optimization programs can have an immediate impact.

3. Value-based pricing requires dedicated budgets. Cost-based pricing often does not. It is done instead by the finance and accounting folks in place. If you want to slowly deploy value-based pricing, you will need extra resources, including staff, travel dollars, training dollars, and so forth. Justifying extra costs in the current context will be a battle.

4. Value-based pricing requires the involvement of your marketing and sales team. Frankly, right now, they are busy securing the pipeline and hunting for new business. It is all hands on deck!

As a value coach and pricing thought leader, I am convinced that value-based pricing is a much better pricing approach. It is hard to design and execute when times are good. It is very challenging in times of turbulence. That does not mean that it is impossible to get started in times of crisis. However, you have to be realistic and focus on the short-term gains to help your organization go through this massive crisis. If you are involved in pricing today in your organization, you can still make an impact and discuss extracting more value from markets

1. Help your marketing and sales teams inject more customer-value thinking in the discussion especially with differentiated products and services.

2. Find areas of strong differentiation in your product range and help teams optimize pricing there. Ask them to run a mini value-based pricing project by focusing on the quantification and extraction of value.

3. Work closely with your digital and innovation teams as they develop new business and revenue models to accelerate the recovery. Convince them to do some additional work on customer value, especially when they discuss value propositions and willingness-to-pay.

4. Run webinars and circulate content on value-based pricing to the go-to-market community. There are plenty of available information on the web. You might also consider joining the Professional Pricing Society to have access to additional expertise and training on value-based pricing.

This crisis is brutal. Many aspects of our business life have been disrupted. Pricing is not immune to the shock. There things that need to be done now to take control of pricing strategies and tactics. All actions and activities must be decided based on their short-term payback to support sales, to close deals, and to protect margins. So doing better cost-based pricing while smartly injecting concepts of value-based pricing is the way to go. It is all hands on deck!

Stephan Liozu is Chief Value Officer of Thales Group and an adjunct professor and research fellow at Case Western Reserve University’s Weatherhead School of Management. He co-authored “Monetizing Data: A Practical Roadmap for Framing, Pricing, and Selling your B2B Digital Offers.”